ParagonDEX

Trade, LP, and farm with verifiable best execution, surplus rewards, and gas-optimized routing.

Real metrics. Real yield. Built for 2026 traders and LPs.

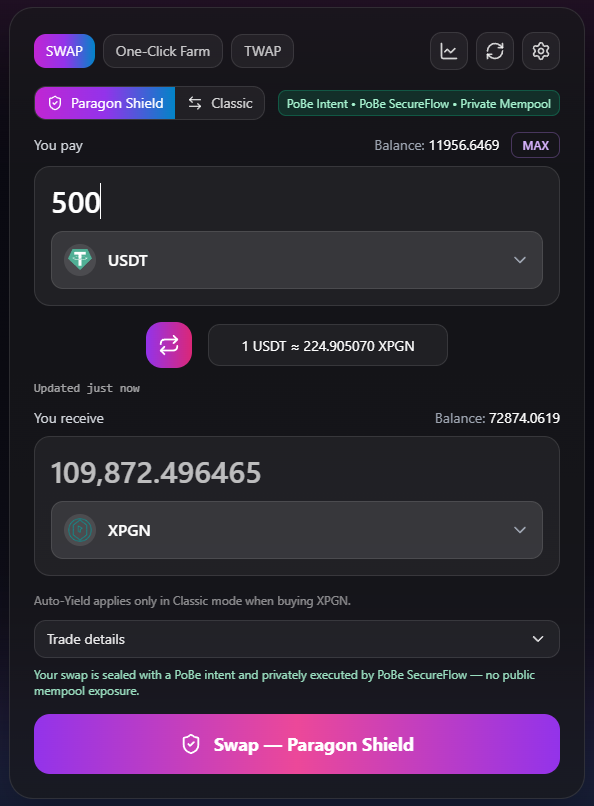

Paragon Shield

MEV protection and fair execution for every trade

The Paragon product stack

Everything you expect from a top DEX in 2025: best-execution swaps, one-click LP & farming, surplus-sharing economics, and a chain built for real DeFi.

One-click DeFi automation.

AI agents powered by elizaOS automate DCA, stop-loss/take-profit, LP rebalancing, and auto-compounding—all under your guardrails.

Autonomous DeFi at Your Command

MEV-proof trading.

Pre-trade screening, oracle guardrails, and Proof of Best Execution (PoBE) ensure fair fills without MEV leakage or sandwich attacks.

Trade Without Fear of MEV

Best execution, surplus shared.

MEV-aware routing delivers best-execution intents, with LP flow rebates returning surplus value to you instead of MEV bots.

Routing That Works For You

The modular L1 for DeFi.

Built for transparency and performance. Migrating from BNB Chain to a sovereign modular L1 designed for next-gen DeFi.

A Blockchain Built for DeFi

Paragon Shield

DeFi security that protects your capital from MEV, toxic flow & unfair execution.

Payflow + Oracle MEV shield

Paragon routes every swap through Payflow and on-chain oracles, cutting out toxic paths, sandwich-prone quotes and stale prices before your order hits the mempool.

- Oracle-checked routes

- Built-in MEV protection

- Toxic-flow filtering

Paragon Ecosystem

Questions?

Answers.

Everything you need to know about Paragon Protocol and DeFi trading.

DeFi (Decentralized Finance) refers to financial services built on blockchain technology that operate without traditional intermediaries like banks. It enables peer-to-peer transactions, trading, lending, and more through smart contracts.

A DeFi exchange (DEX) is a decentralized platform where users can trade cryptocurrencies directly from their wallets without custodians. Unlike centralized exchanges, you maintain full control of your assets throughout the trading process.

Yes, Paragon Protocol is a next-generation DeFi exchange offering MEV-protected swaps, AI-powered automation, and intent-based routing. We're building the complete stack—from trading infrastructure to our own modular L1 blockchain.

Volts AI Agents are powered by elizaOS and execute automated DeFi strategies like DCA, stop-loss/take-profit, LP rebalancing, and auto-compounding. You set your risk parameters once, and the agents handle 24/7 execution within your guardrails while you maintain full custody.

Yes. Paragon is non-custodial—you always maintain control of your funds. Our smart contracts are audited by CertiK, and Paragon Shield provides MEV protection on every trade. We never hold your assets; trades execute directly from your wallet.

Connect your Web3 wallet (MetaMask, WalletConnect, etc.), select the tokens you want to swap, enter the amount, and confirm. Paragon Shield automatically protects you from MEV while finding the best execution across multiple liquidity sources.

Intent-based swaps let you specify your desired outcome (e.g., 'I want 1 ETH') rather than a specific route. Solvers compete to fulfill your intent at the best possible price, often beating traditional AMM routing.

Proof of Best Execution (PoBE) is cryptographic proof that your trade received the best available price across all liquidity sources at the time of execution. It's verifiable on-chain and ensures you're getting fair fills without MEV extraction.

Paragon charges competitive swap fees that are transparently displayed before each transaction. With our LP rebate system, a portion of the surplus value generated by your trades flows back to you, often offsetting the fee entirely.

Paragon Chain is our sovereign modular L1 blockchain designed specifically for DeFi. It features native MEV protection, sub-second finality (target 400ms blocks), built-in account abstraction, and a modular architecture for maximum scalability. Currently in development, migrating from BNB Chain.

MEV (Maximal Extractable Value) protection prevents bots from front-running, sandwiching, or exploiting your trades. Paragon Shield uses pre-trade screening, oracle guardrails, and proof of best execution to ensure fair fills.

Paragon combines MEV protection, AI automation, surplus-sharing economics, and intent-based routing—all audited by CertiK. Plus, we're building our own modular L1 with native MEV protection, giving you the best execution and security in DeFi.